Share Market Updates: Today is the sixth day of continuous decline in the Indian stock market. In early trade, Sensex opened 0.17 percent lower at 83,433.30, while Nifty slipped 0.60 percent and started trading at 25,529 level. During this period, HDFC Life, SBI Life, Shriram Finance and Hindalco were among the top gainers in Nifty 50. While on the other hand, Apollo Hospitals, Max Healthcare, Larsen & Toubro and Reliance Industries were the top losers.

The decline in the Indian equity market continued in intraday trading even till 11 am. The Sensex fell 450.46 points or 0.54 percent to 83,125.78, while the Nifty fell 125.75 points or 0.49 percent to trade around 25,557.55.

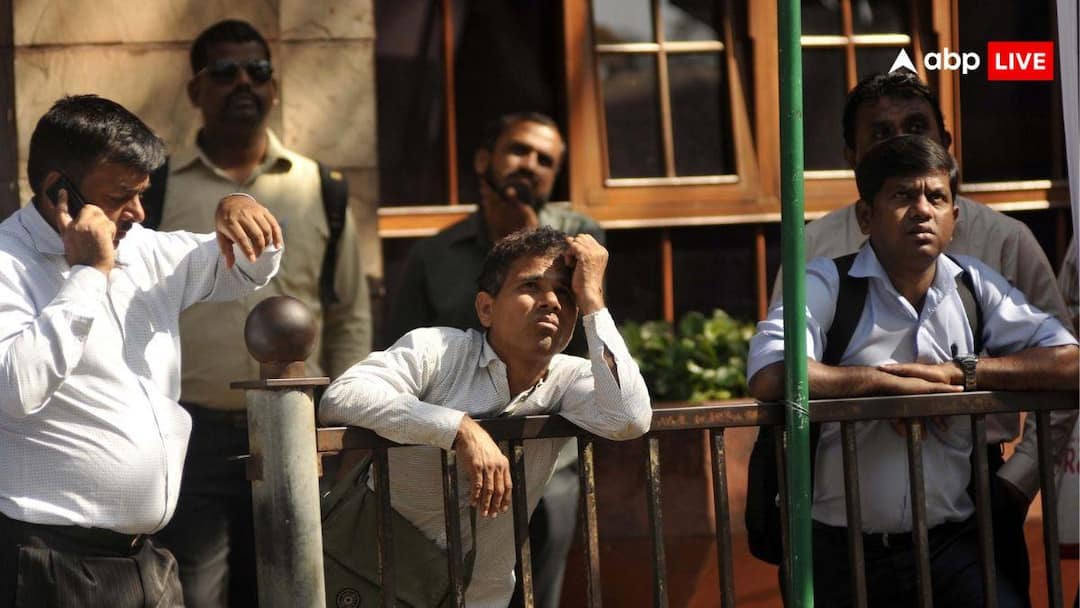

Investors lost Rs 17 lakh crore

It is being told that due to this decline in the last six trading sessions, investors have suffered a loss of about Rs 17 lakh crore. On January 8, BSE Sensex slipped more than 700 points to the day’s lowest level of 82,864, while NSE Nifty 50 also fell by more than 150 points to below the level of 25,500.

From the closing high of 85,762.01 on January 42, the Sensex has fallen by more than 2,718 points and the Nifty has also fallen by about 3 percent during the same period, reaching a low of 25,529.05. This sharp fall comes after the market’s worst weekly performance in more than three months. In these six days, the total market capitalization of all BSE-listed companies has fallen by about Rs 18.5 lakh crore to about Rs 462.68 lakh crore.

Why is the market faltering?

According to the report of The Financial Express, Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Investments, said, “The market has become quite weak, which is under pressure from India-related and global geopolitical events. The ongoing drama regarding the US-India trade deal is becoming more complicated with the strange comments of the US President. This is having an impact on the market. Geopolitical developments in Venezuela, Iran The markets are also watching Trump’s threats regarding the crisis with concern. This has led to a rise in the India Volatility Index (VIX), indicating greater volatility ahead.”

He further said, “There is no decision on Trump tariffs from the US Supreme Court on Friday; there is no clarity on when it will happen. However, it can happen any time so investors will have to keep an eye on the developments on this front. Apart from this, Q3 results and management commentary from tech companies and banking and big companies like RIL will influence the market trend in the short term.”

How is the condition of Asian markets?

Asian markets started trading on the first day of the week on a positive note. During this period, Australia’s S&P/ASX 200 is trading up by 0.71 percent. At the same time, South Korea’s Kospi also gained 0.83 percent, while Kosdaq index rose 0.4 percent. Meanwhile, Japan’s market is closed due to national holiday.

US market trading

On Friday, January 9, US equity benchmarks closed with gains. During this period, all three major indexes managed to reach record levels. The S&P 500 closed 0.65 percent higher at 6,966.28, which was its highest intraday level so far. The Nasdaq Composite gained 0.81 percent to 23,671.35, while the Dow Jones Industrial Average jumped 237.96 points, or 0.48 percent, to close at a new record high of 49,504.07.

us dollar

The US Dollar Index (DXY) fell 0.01 percent on Monday morning to a one-month high of 99.13. Earlier on January 09, the rupee strengthened by 0.14 percent and closed at 90.17 against the dollar. This index measures the strength or weakness of the US dollar against the other major currencies included in the basket, the British Pound, Euro, Swedish Krona, Japanese Yen, Swiss Franc.

price of crude oil

Oil prices remained largely stable on Monday amid intensified protests in Iran as investors eyed a possible disruption in oil supplies from Iran, an OPEC member country, and supplies from Venezuela with US approval. Crude oil prices rose in early trade on Friday, with US benchmark WTI rising 0.49 per cent to $59.41 per barrel, while Brent crude was seen trading 0.41 per cent higher at around $63.62 per barrel.

Also read:

It will be expensive, yet there is a hurry to buy… Why is Reliance waiting for the supply of Venezuelan crude oil from America?