This is a pleasant news for Indian currency amidst the boom in domestic share Bajad. After an increase in the rupee against the dollar, he has compensated for all the damage so far in 2025. With the rise in domestic stock markets and the support of the fresh investment of foreign funds, the rupee continued to rise in the seventh consecutive trading session in the interbank foreign currency exchange market on Monday. It climbed 37 paise to close at 85.61 per dollar. Due to this boom, the loss of rupee has ended in 2025. & nbsp;

Traders said that apart from this, the fall in crude oil prices globally and the ongoing weakness in the dollar has also strengthened the notion of strength. He said that on the other hand, the risk ranging from lack of cash to reply duty remains challenges for the rupee. & Nbsp;

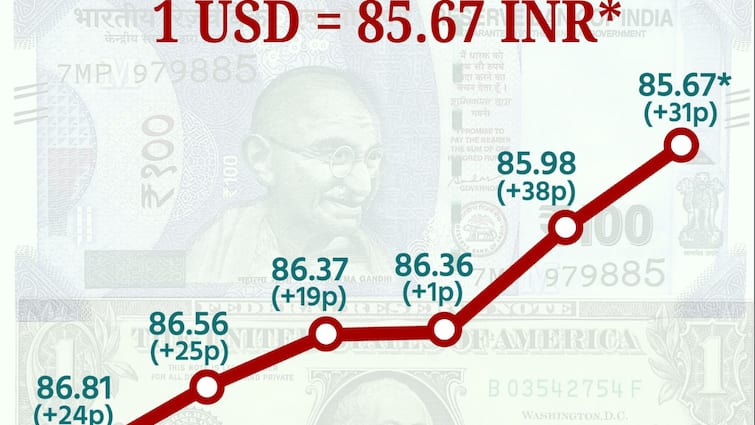

Rupee opened at 85.93 per dollar in interbank foreign currency exchange market. During trading, it touched a high level of 85.49 per dollar and a low of 86.01 per dollar. At the end of the trading, the rupee closed at 85.61 per dollar, which is a gain of 37 paise from the previous closed level. The rupee closed at 85.98 per dollar against the US dollar on Friday. & Nbsp;

The rupee recorded an edge in the seventh consecutive trading session against the dollar. With this, the rupee compensated all its losses for the year 2025. On December 31, 2024, the rupee closed at 85.64 per dollar against the dollar. Last month, the rupee reached its record of 87.59 against the US dollar. & Nbsp;

HDFC Securities Research analyst Dilip Parmar said, “& lsquo; & lsquo; Indian rupee compensated the annual loss from foreign banks and exporters by selling dollars before adjustment at the end of the financial year.” Whereas Reserve Bank of India Dollar-Rupaya & Lsquo; Swap & rsquo; Between the government banks stayed away from shopping. & Rsquo; & rsquo; Parmar further said that before the implementation of the counter -duty on April 2, the assumption of the US representative’s arrival in India has become positive. Apart from this, the purchase of foreign funds in domestic stocks also gave good support to the rupee.

Meanwhile, the dollar index, depicting the US dollar status against six major currencies, fell 0.09 percent to 103.99. International standard Brent crude rose 0.54 percent to $ 72.55 per barrel. In the domestic stock market, the BSE Sensex rose by 1,078.87 points to 77,984.38 points, while the Nifty rose 307.95 points to close at 23,658.35 points. According to the stock market data, foreign institutional investors (FIIs) remained pure buying in the capital market. He purely bought shares worth Rs 3,055.76 crore on Monday.