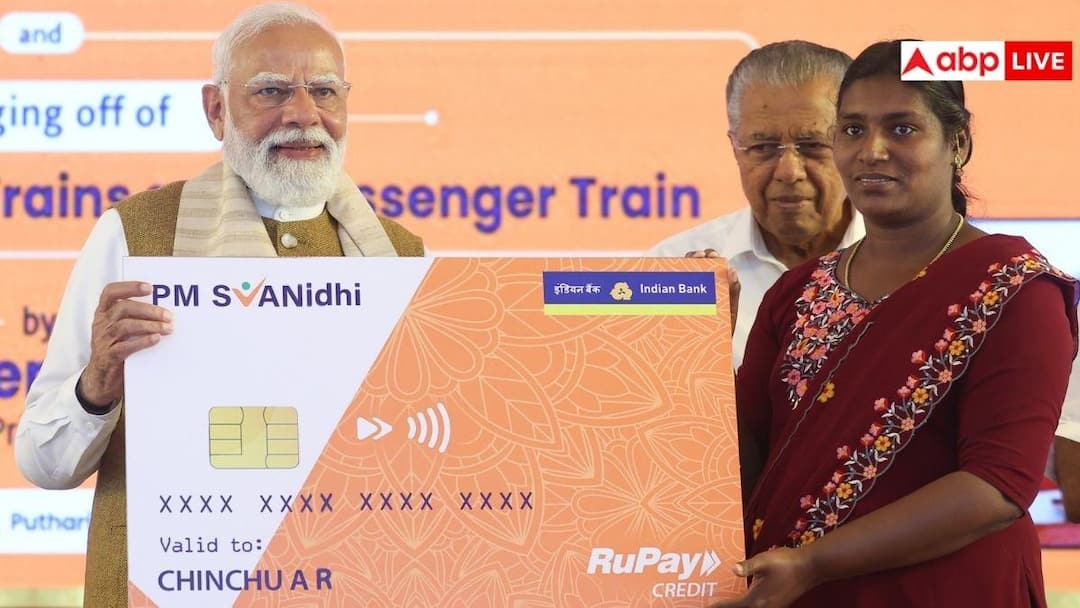

PM SVANidhi Credit Card: It is no longer as difficult for footpath workers, street vendors and small street vendors to raise money as before. The government has launched a special credit card under the PM Swanidhi scheme. Due to which now credit cards will not be only for salaried people.

Through this card, vendors will be able to connect with the banking system without any guarantee and will be able to spend as per their need. Its objective is to ensure that small businessmen avoid moneylenders and get cheap, safe and easy finance. This is the reason why PM Swanidhi Credit Card is being considered a big change for small businesses. Know which documents will be required for this.

What is PM Swanidhi Credit Card?

PM Swanidhi Credit Card is a RuPay based card. Which works just like a normal credit card. With this you can buy everyday items, pay bills and make digital payments. It will start with a limit of Rs 10,000. Which will later be increased to Rs 30 thousand. The biggest feature of this card is that no interest will have to be paid on returning the money for 20 to 50 days. The card will be valid for 5 years and will be linked to UPI. Through which payment can also be made by scanning the QR code.

Who can make this card?

This card will be available only to those people who are already associated with PM Swanidhi Yojana. Those who have repaid the second loan on time and are eligible for the third loan or who have taken the third loan. He can apply for this. The age of the applicant should be between 21 to 65 years and he should not be a defaulter of any bank or credit card. With this card, small businessmen can buy goods for their work. You can convert the expenses into EMI and make cashless payment as and when required. Interest on EMI has also been kept low.

Documents required for application

Application for PM Swanidhi Credit Card can be made online. For this, you will have to go to pmsvanidhi.mohua.gov.in website or PMS mobile app and select Apply for Credit Card option. After logging in with the mobile number, verification will be done with Aadhaar and vendor details. Then you will have to fill the form, choose the bank and complete eKYC. For this, some important documents will be required which include Aadhar card, PAN card, vending certificate or identity card, savings bank account details and address proof.

Also read: With RBI and NABARD, the salary of these employees and pensioners will increase, know how much will be the increase and how much arrears will be received?