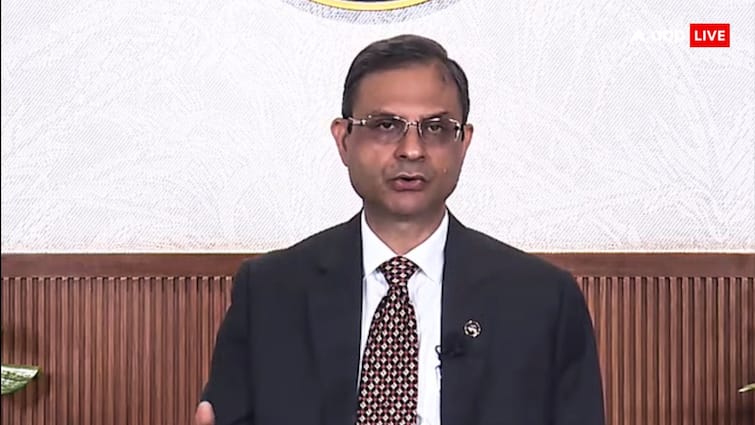

RBI Repo Rate Cut: After the three -day meeting of the RBI monetary committee, Governor Sanjay Malhotra on Wednesday announced not making any changes in the repo rate. Along with this, they have retained the growth rate of 6.5 percent in GDP during the current financial year (2025-26). Also, the central bank has estimated to reduce the estimate of inflation to 3.7 percent to 3.1 percent.

Let us know the five big things of Governor Sanjay Malhotra-

1. sharing the decision of the third bilateral monetary policy for FY 2025-26, RBI Governor Sanjay Malhotra said that better Southwest monsoon, low inflation, capacity utilization and favorable financial conditions are supporting domestic economic activities. Assistant monetary, regulatory and fiscal policies including strong government capital expenditure are also expected to raise demand. Due to continuous increase in construction and trade in the coming months, there is a possibility of speed in the service sector.

2. Governor Sanjay Malhotra said that the growth rate is strong and remains in line with estimates. However, this is less than our aspirations. The uncertainty of the fee still remains. The benefit of monetary policy is still available. Since February 2025, the impact of one percent cut in repo rate on the economy is still going on.

3. RBI Governor said that the domestic growth rate is stable and is roughly moving as per the assessment. However, some high-existing indicators (such as GST collection, export, power consumption etc.) have given mixed indications in May-June. Malhotra said that there is stability in rural consumption, while the improvement in urban consumption has been observed, especially discretionary expenditure is slow.

4. Sanjay Malhotra said that long-lasting geopolitical stress, global uncertainties and adverse conditions arising from instability in global financial markets are inciting risk to the growth scenario. The governor said, “Keeping all these factors in mind, the actual GDP growth rate for 2025-26 is estimated to be 6.5 percent.” Under this, 6.5 percent in the first quarter, 6.7 percent in the second quarter, 6.6 percent in the third quarter and 6.3 percent in the fourth quarter. At the same time, the actual GDP growth rate for the first quarter of FY 2026-27 is estimated to be 6.6 percent. Risks are equally balanced on both sides.

5. On inflation, the governor said that the consumer price index (CPI) based inflation fell to the eighth consecutive month to 77 months low in June. This decline in inflation has declined mainly due to a steep fall in food inflation. He said, “Inflation estimates for 2025-26 have been more favorable than expected in June.”

Also read: RBI MPC Meeting: Interest rates are not changed between tariff tension, RBI Governor Sanjay Malhotra announced