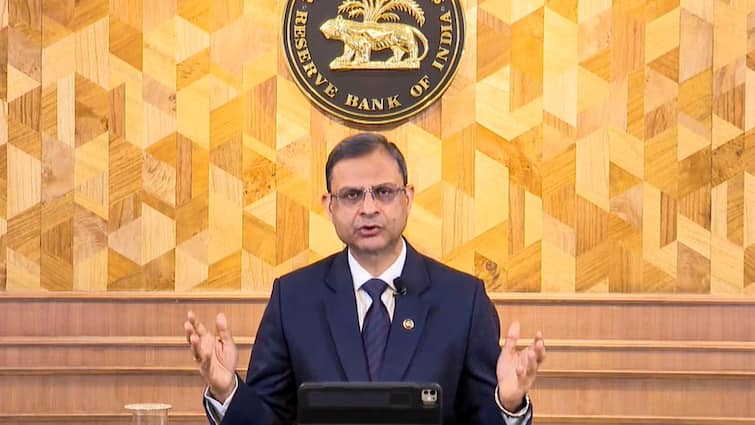

Repo Rate: The Reserve Bank of India has decided to reduce the repo rate by 0.25%. After this, the rape rate has come down to 6.0%, this decision was taken by the RBI on Wednesday morning after the MPC meeting from April 7 to 9. After this, there will be a decrease in people’s home and car loan EMI. This is the second consecutive time RBI has decided to cut the repo rate. However, experts were already guessing the RBI’s move.

In February last, the repo rate of 0.25 percent was announced by the RBI, after which the repo rate was reduced from 6.50% to 6.25%. The repo rate was increased to 6.50% in June 2023 by RBI. That is, this change was made in 5 years.

However, the hope of any change in the rate of deposits in the bank is very low. That is, the benefits can be given to those taking home loans from the bank, but the depositors are not going to benefit from it.

The Target of Control of Reserve Bank of India for inflation is between 2% to 6%. At present, India is made in this band. This means that now the focus of RBI will be on boosting growth. This will be the news of small business, startups and the general public. Significantly, the repo rate was increased to 6.50 percent in the month of June 2023 by RBI. That is, this change was made in five years.

Also read: Life saving drugs will also bear the havoc of Trump’s tariff, know how it will be affected by India