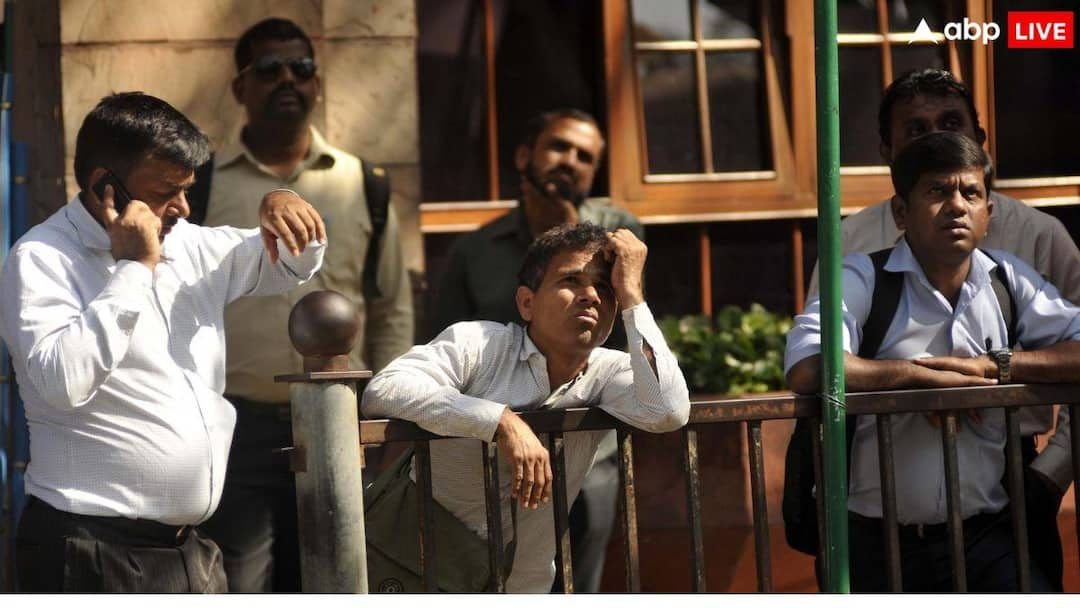

Share Market Today: There was a big fall in the Indian stock market on Monday itself, the first trading day of the week. Both Sensex and Nifty remained under pressure due to fear of increasing global trade tension and mixed results of big companies. The benchmark BSE Sensex fell by more than 600 points to the day’s low of 82953, while the NSE Nifty 50 also slipped by more than 150 points to below the level of 25550. During this period, stock market investors appeared cautious.

Why is the stock market trembling?

The fear of trade war is haunting

The global market is going through a difficult phase these days because US President Donald Trump’s new orders and disruptive policies have troubled investors. In recent times, America has intensified its efforts to capture Greenland. In this sequence, it has been decided to impose 10 percent tariff against 8 European countries standing against it. These include Denmark, Norway, France, Germany, Sweden, United Kingdom, Netherlands and Finland. Obviously, these countries are also not going to remain silent after this order of Trump. Investors are currently waiting for their counterattack.

Dr. VK Vijayakumar, Chief Investment Strategist, Geojit Financial Services, said that there may continue to be fluctuations in the global market. He said, “The days ahead will be full of ups and downs, in which major geopolitical and geoeconomic developments will have an impact on the market. We don’t know what impact President Trump’s troubling policies will have on international trade. If America imposes 10 percent tariff on eight European countries from February 1 and increases it to 25 percent in June, then retaliatory action is almost certain.” He further said that if this happens, a big trade war can start, which will be negative for the global market. However, he also said that Trump sometimes backs down and can soften his stance.

weak quarter results

Another reason for this delicate situation of the stock market is that the quarterly results of big companies are not meeting the expectations. Benchmarks fell due to weak earnings of big companies like Reliance Industries and ICICI Bank. This pressure also fell on financial and domestic cyclical stocks, which led to the initial fall.

Selling pressure on stock market

Foreign portfolio investors continue to withdraw money from Indian equities, putting pressure on the market. Weak rupee and global risk-off environment are further increasing the selling. So far in January this year, foreign portfolio investors (FPIs) have sold Indian shares worth more than Rs 22530 crore ($2.5 billion).

Ponmudi R, CEO, Enrich Money, said that the cautious start of the market has been dictated by domestic consolidation, pre-budget positioning and mixed global cues. He said that the weakness of FPI and weak rupee are keeping the overall sentiment cautious.

Also read:

India Tariff: America lost its sleep due to India’s 30 percent tariff, American senator rushed to meet the Foreign Minister